BERMUDA MONETARY AUTHORITY

When visiting Bermuda, make sure to stop by the Bermuda Monetary Authority’s (Authority or BMA) Museum of Notes and Coins, where you can purchase beautiful commemorative coins. The coins highlight the unique history and diverse wildlife of Bermuda. In 2019, the BMA launched the first coin in its flower series, featuring the Bermudiana, Bermuda’s nation- al flower. This was followed by the release of the Easter lily coin in 2020, a symbol of Bermuda’s rich history and cultural heritage. The Hibiscus coin was introduced in 2021, and in 2022, the Oleander coin was released. In 2023, the BMA unveiled the Bird of Paradise coin, which is the fifth in the flower series. The final coin, the Bermuda Buttercup, is set to be released in 2025. The Authority’s Notes and Coins Exhibit is located at 43 Victoria Street in Hamilton and is open Monday through Friday from 9 a.m. to 4 p.m. It is supported by a Note Exhibit located in the Commissioner’s House at National Museum of Bermuda in Dockyard.

All “Shopping”

https://visitbermudanow.com/wp-content/uploads/2025/04/1-27.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2025-04-28 03:32:482025-04-28 03:32:49ISLAND SHOP

https://visitbermudanow.com/wp-content/uploads/2025/04/1-27.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2025-04-28 03:32:482025-04-28 03:32:49ISLAND SHOP https://visitbermudanow.com/wp-content/uploads/2025/04/1-4.jpeg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2025-04-28 03:19:302025-04-28 03:33:23EVE’S GARDEN

https://visitbermudanow.com/wp-content/uploads/2025/04/1-4.jpeg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2025-04-28 03:19:302025-04-28 03:33:23EVE’S GARDEN https://visitbermudanow.com/wp-content/uploads/2025/04/1-13.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2025-04-27 03:52:272025-04-27 03:52:29MIDDLE MAN

https://visitbermudanow.com/wp-content/uploads/2025/04/1-13.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2025-04-27 03:52:272025-04-27 03:52:29MIDDLE MAN https://visitbermudanow.com/wp-content/uploads/2025/04/1-11.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2025-04-27 03:42:112025-04-27 03:44:34LOOKIE LOOKIE

https://visitbermudanow.com/wp-content/uploads/2025/04/1-11.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2025-04-27 03:42:112025-04-27 03:44:34LOOKIE LOOKIE https://visitbermudanow.com/wp-content/uploads/2025/04/1-10.jpg

401

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2025-04-27 02:14:012025-04-27 02:14:51DELLA VALLE SANDALS

https://visitbermudanow.com/wp-content/uploads/2025/04/1-10.jpg

401

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2025-04-27 02:14:012025-04-27 02:14:51DELLA VALLE SANDALS https://visitbermudanow.com/wp-content/uploads/2024/04/1-21.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 06:18:272024-04-30 06:18:29OUTERBRIDGE’S ORIGINAL

https://visitbermudanow.com/wp-content/uploads/2024/04/1-21.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 06:18:272024-04-30 06:18:29OUTERBRIDGE’S ORIGINAL https://visitbermudanow.com/wp-content/uploads/2024/04/1-14.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 06:12:302024-04-30 06:12:32MARVALAN’S HANDBAGS & ACCESSORIES

https://visitbermudanow.com/wp-content/uploads/2024/04/1-14.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 06:12:302024-04-30 06:12:32MARVALAN’S HANDBAGS & ACCESSORIES https://visitbermudanow.com/wp-content/uploads/2024/04/1-12.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 06:01:282025-04-27 03:36:20KULTURA BERMUDA CULTURE

https://visitbermudanow.com/wp-content/uploads/2024/04/1-12.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 06:01:282025-04-27 03:36:20KULTURA BERMUDA CULTURE https://visitbermudanow.com/wp-content/uploads/2024/04/1-15.png

225

225

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 05:53:432025-04-26 07:51:37HARBOUR NIGHTS

https://visitbermudanow.com/wp-content/uploads/2024/04/1-15.png

225

225

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 05:53:432025-04-26 07:51:37HARBOUR NIGHTS https://visitbermudanow.com/wp-content/uploads/2024/04/1-10.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 05:39:502024-04-30 05:39:52DREAMSCAPE DESIGNS

https://visitbermudanow.com/wp-content/uploads/2024/04/1-10.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 05:39:502024-04-30 05:39:52DREAMSCAPE DESIGNS https://visitbermudanow.com/wp-content/uploads/2024/04/1-16.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 05:13:182024-04-30 05:13:20BERMUDA JEWELLERY LTD

https://visitbermudanow.com/wp-content/uploads/2024/04/1-16.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 05:13:182024-04-30 05:13:20BERMUDA JEWELLERY LTD https://visitbermudanow.com/wp-content/uploads/2024/04/1-7.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 03:15:082024-04-30 03:22:50DISCOVERY WINES & SPIRITS

https://visitbermudanow.com/wp-content/uploads/2024/04/1-7.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 03:15:082024-04-30 03:22:50DISCOVERY WINES & SPIRITS https://visitbermudanow.com/wp-content/uploads/2023/06/sargasso.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-03 01:35:072023-06-03 01:35:08SARGASSO / PRONTO RETAIL & FOOD SHOPPING DELIVERY

https://visitbermudanow.com/wp-content/uploads/2023/06/sargasso.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-03 01:35:072023-06-03 01:35:08SARGASSO / PRONTO RETAIL & FOOD SHOPPING DELIVERY https://visitbermudanow.com/wp-content/uploads/2023/06/THINGS-WE-LOVE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-02 00:16:012023-06-02 02:13:37THE THINGS WE LOVE

https://visitbermudanow.com/wp-content/uploads/2023/06/THINGS-WE-LOVE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-02 00:16:012023-06-02 02:13:37THE THINGS WE LOVE https://visitbermudanow.com/wp-content/uploads/2023/06/RUM-BARREL-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 23:56:002023-06-02 00:07:02THE RUM BARREL

https://visitbermudanow.com/wp-content/uploads/2023/06/RUM-BARREL-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 23:56:002023-06-02 00:07:02THE RUM BARREL https://visitbermudanow.com/wp-content/uploads/2023/06/Mussels-Jewellery-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

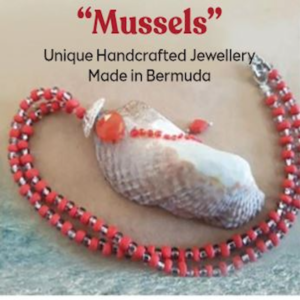

Mark Cramer2023-06-01 10:01:392023-06-02 04:35:03MUSSELS JEWELLERY

https://visitbermudanow.com/wp-content/uploads/2023/06/Mussels-Jewellery-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 10:01:392023-06-02 04:35:03MUSSELS JEWELLERY https://visitbermudanow.com/wp-content/uploads/2023/06/MARKS-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 09:44:532023-06-01 09:44:55MARKS & SPENCER

https://visitbermudanow.com/wp-content/uploads/2023/06/MARKS-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 09:44:532023-06-01 09:44:55MARKS & SPENCER https://visitbermudanow.com/wp-content/uploads/2023/06/LUSSO-1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 09:25:362025-04-27 03:45:49LUSSO

https://visitbermudanow.com/wp-content/uploads/2023/06/LUSSO-1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 09:25:362025-04-27 03:45:49LUSSO https://visitbermudanow.com/wp-content/uploads/2023/06/ENGLISH-SPORTS-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 05:20:072025-04-28 02:05:50THE ENGLISH SPORTS SHOP

https://visitbermudanow.com/wp-content/uploads/2023/06/ENGLISH-SPORTS-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 05:20:072025-04-28 02:05:50THE ENGLISH SPORTS SHOP https://visitbermudanow.com/wp-content/uploads/2023/06/CUARENTOS-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:58:482023-06-01 05:06:24CUARENTA BUCANEROS LIMITED

https://visitbermudanow.com/wp-content/uploads/2023/06/CUARENTOS-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:58:482023-06-01 05:06:24CUARENTA BUCANEROS LIMITED https://visitbermudanow.com/wp-content/uploads/2023/06/CHATHAM-HOUSE-FEATURE.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:41:012025-04-27 02:01:01CHATHAM HOUSE

https://visitbermudanow.com/wp-content/uploads/2023/06/CHATHAM-HOUSE-FEATURE.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:41:012025-04-27 02:01:01CHATHAM HOUSE https://visitbermudanow.com/wp-content/uploads/2023/06/BERMUDA-FUDGE-FEATURE.jpeg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:21:562025-04-27 01:57:40BERMUDA FUDGE CO.

https://visitbermudanow.com/wp-content/uploads/2023/06/BERMUDA-FUDGE-FEATURE.jpeg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:21:562025-04-27 01:57:40BERMUDA FUDGE CO. https://visitbermudanow.com/wp-content/uploads/2023/06/BERMUDA-FRAGRANCE-FEATURE.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:02:062023-06-01 04:13:07BERMUDA FRAGRANCE COLLECTION

https://visitbermudanow.com/wp-content/uploads/2023/06/BERMUDA-FRAGRANCE-FEATURE.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:02:062023-06-01 04:13:07BERMUDA FRAGRANCE COLLECTION https://visitbermudanow.com/wp-content/uploads/2023/06/CRISSON-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 01:51:482025-04-27 01:43:19CRISSON & HIND AFRICAN GALLERY

https://visitbermudanow.com/wp-content/uploads/2023/06/CRISSON-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 01:51:482025-04-27 01:43:19CRISSON & HIND AFRICAN GALLERY https://visitbermudanow.com/wp-content/uploads/2023/05/BERMUDA-SHOP.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-05-31 04:42:592025-04-26 10:54:20CAROLE HOLDING SHOP

https://visitbermudanow.com/wp-content/uploads/2023/05/BERMUDA-SHOP.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-05-31 04:42:592025-04-26 10:54:20CAROLE HOLDING SHOP https://visitbermudanow.com/wp-content/uploads/2022/09/modern-lifestyle-feature.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-25 04:47:062023-07-11 00:38:27MODERN LIFESTYLE

https://visitbermudanow.com/wp-content/uploads/2022/09/modern-lifestyle-feature.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-25 04:47:062023-07-11 00:38:27MODERN LIFESTYLE https://visitbermudanow.com/wp-content/uploads/2022/09/MERCH-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 11:17:492022-09-23 03:48:15MERCH.

https://visitbermudanow.com/wp-content/uploads/2022/09/MERCH-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 11:17:492022-09-23 03:48:15MERCH. https://visitbermudanow.com/wp-content/uploads/2022/09/THE-BERMUDA-CRAFT-MARKET.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 04:23:142022-09-23 03:34:01BERMUDA CRAFT MARKET

https://visitbermudanow.com/wp-content/uploads/2022/09/THE-BERMUDA-CRAFT-MARKET.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 04:23:142022-09-23 03:34:01BERMUDA CRAFT MARKET https://visitbermudanow.com/wp-content/uploads/2022/09/swiss-jewellers.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 04:12:242022-09-23 03:28:09SWISS JEWELLERS

https://visitbermudanow.com/wp-content/uploads/2022/09/swiss-jewellers.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 04:12:242022-09-23 03:28:09SWISS JEWELLERS https://visitbermudanow.com/wp-content/uploads/2022/09/ER-AUBREY-JEWELLERS-1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 03:36:452022-09-23 03:25:30ER AUBREY JEWELLERS LIMITED

https://visitbermudanow.com/wp-content/uploads/2022/09/ER-AUBREY-JEWELLERS-1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 03:36:452022-09-23 03:25:30ER AUBREY JEWELLERS LIMITED https://visitbermudanow.com/wp-content/uploads/2022/09/59-Front2-1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 03:29:552023-06-01 03:58:2059 FRONT

https://visitbermudanow.com/wp-content/uploads/2022/09/59-Front2-1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 03:29:552023-06-01 03:58:2059 FRONT https://visitbermudanow.com/wp-content/uploads/2022/05/Robertsons-Drug-Store-.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 09:58:182024-04-30 06:21:10ROBERTSON’S DRUG STORE

https://visitbermudanow.com/wp-content/uploads/2022/05/Robertsons-Drug-Store-.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 09:58:182024-04-30 06:21:10ROBERTSON’S DRUG STORE https://visitbermudanow.com/wp-content/uploads/2022/05/Frangipani-St-George.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 09:50:572023-06-01 09:07:43FRANGIPANI

https://visitbermudanow.com/wp-content/uploads/2022/05/Frangipani-St-George.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 09:50:572023-06-01 09:07:43FRANGIPANI https://visitbermudanow.com/wp-content/uploads/2022/05/dock-shop.png

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 09:33:402022-09-23 03:45:40DOCKSHOP AT PIER 41 MARINA

https://visitbermudanow.com/wp-content/uploads/2022/05/dock-shop.png

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 09:33:402022-09-23 03:45:40DOCKSHOP AT PIER 41 MARINA https://visitbermudanow.com/wp-content/uploads/2022/05/Dockyard-Pharmacy-1.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 05:14:302025-04-27 02:17:06DOCKYARD PHARMACY

https://visitbermudanow.com/wp-content/uploads/2022/05/Dockyard-Pharmacy-1.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 05:14:302025-04-27 02:17:06DOCKYARD PHARMACY https://visitbermudanow.com/wp-content/uploads/2022/05/Diamonds-International-Dockyard.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 05:03:152023-06-01 05:13:00DIAMONDS INTERNATIONAL BERMUDA

https://visitbermudanow.com/wp-content/uploads/2022/05/Diamonds-International-Dockyard.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 05:03:152023-06-01 05:13:00DIAMONDS INTERNATIONAL BERMUDA https://visitbermudanow.com/wp-content/uploads/2022/05/Churchills-Ltd.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 04:53:262025-04-27 02:02:07CHURCHILL’S LTD.

https://visitbermudanow.com/wp-content/uploads/2022/05/Churchills-Ltd.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 04:53:262025-04-27 02:02:07CHURCHILL’S LTD. https://visitbermudanow.com/wp-content/uploads/2022/05/9-Parishes.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 04:12:282023-06-01 02:10:039 PARISHES AUTHENTIC RUM

https://visitbermudanow.com/wp-content/uploads/2022/05/9-Parishes.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 04:12:282023-06-01 02:10:039 PARISHES AUTHENTIC RUM https://visitbermudanow.com/wp-content/uploads/2022/05/The-Littlest-Drawbridge-Gift-Shop.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:55:512025-04-27 03:37:54LITTLEST DRAWBRIDGE GIFT SHOP

https://visitbermudanow.com/wp-content/uploads/2022/05/The-Littlest-Drawbridge-Gift-Shop.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:55:512025-04-27 03:37:54LITTLEST DRAWBRIDGE GIFT SHOP https://visitbermudanow.com/wp-content/uploads/2022/05/fair-trade.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:49:502025-04-27 02:18:11FAIR TRADE BERMUDA SHOP

https://visitbermudanow.com/wp-content/uploads/2022/05/fair-trade.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:49:502025-04-27 02:18:11FAIR TRADE BERMUDA SHOP https://visitbermudanow.com/wp-content/uploads/2022/05/GRAND-BAZAAR.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:32:162022-09-23 03:44:08GRAND BAZAAR

https://visitbermudanow.com/wp-content/uploads/2022/05/GRAND-BAZAAR.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:32:162022-09-23 03:44:08GRAND BAZAAR https://visitbermudanow.com/wp-content/uploads/2022/05/touche.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:15:562022-09-23 03:30:07TOUCHE’

https://visitbermudanow.com/wp-content/uploads/2022/05/touche.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:15:562022-09-23 03:30:07TOUCHE’ https://visitbermudanow.com/wp-content/uploads/2022/05/Phoenix-Stores-Ber.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:50:492025-04-30 01:59:38PHOENIX STORES LTD.

https://visitbermudanow.com/wp-content/uploads/2022/05/Phoenix-Stores-Ber.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:50:492025-04-30 01:59:38PHOENIX STORES LTD. https://visitbermudanow.com/wp-content/uploads/2022/05/TABS-The-Authentic-Bermuda-Shorts.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:44:412025-04-28 02:04:50TABS – THE AUTHENTIC BERMUDA SHORTS

https://visitbermudanow.com/wp-content/uploads/2022/05/TABS-The-Authentic-Bermuda-Shorts.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:44:412025-04-28 02:04:50TABS – THE AUTHENTIC BERMUDA SHORTS https://visitbermudanow.com/wp-content/uploads/2022/05/Goslings-Merchandise.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:30:562022-09-23 03:32:53GOSLINGS MERCHANDISE

https://visitbermudanow.com/wp-content/uploads/2022/05/Goslings-Merchandise.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:30:562022-09-23 03:32:53GOSLINGS MERCHANDISE https://visitbermudanow.com/wp-content/uploads/2022/05/Goslings.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:26:422023-06-01 09:10:25GOSLINGS

https://visitbermudanow.com/wp-content/uploads/2022/05/Goslings.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:26:422023-06-01 09:10:25GOSLINGS https://visitbermudanow.com/wp-content/uploads/2022/05/p-tech.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:14:412024-04-26 03:52:15P-TECH

https://visitbermudanow.com/wp-content/uploads/2022/05/p-tech.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:14:412024-04-26 03:52:15P-TECH https://visitbermudanow.com/wp-content/uploads/2022/05/Flying-Colours-1.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:06:482025-04-27 02:22:08FLYING COLOURS

https://visitbermudanow.com/wp-content/uploads/2022/05/Flying-Colours-1.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:06:482025-04-27 02:22:08FLYING COLOURS https://visitbermudanow.com/wp-content/uploads/2022/05/confections_logo.png

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-28 08:20:582025-04-27 05:23:54CONFECTIONS

https://visitbermudanow.com/wp-content/uploads/2022/05/confections_logo.png

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-28 08:20:582025-04-27 05:23:54CONFECTIONS https://visitbermudanow.com/wp-content/uploads/2022/05/Bermuda-Duty-Free-BDF.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-28 07:05:002022-09-23 03:22:10BERMUDA DUTY FREE (BDF)

https://visitbermudanow.com/wp-content/uploads/2022/05/Bermuda-Duty-Free-BDF.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-28 07:05:002022-09-23 03:22:10BERMUDA DUTY FREE (BDF) https://visitbermudanow.com/wp-content/uploads/2022/05/27-Century-Boutique.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-28 06:47:162022-09-23 03:20:2627TH CENTURY BOUTIQUE

https://visitbermudanow.com/wp-content/uploads/2022/05/27-Century-Boutique.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-28 06:47:162022-09-23 03:20:2627TH CENTURY BOUTIQUE https://visitbermudanow.com/wp-content/uploads/2022/05/LITTLE-LONGTAILS.png

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-27 00:16:542022-09-23 03:33:26LITTLE LONGTAILS BABY & RENTAL EQUIPMENT

https://visitbermudanow.com/wp-content/uploads/2022/05/LITTLE-LONGTAILS.png

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-27 00:16:542022-09-23 03:33:26LITTLE LONGTAILS BABY & RENTAL EQUIPMENT https://visitbermudanow.com/wp-content/uploads/2022/05/Walker-Christopher-Goldsmiths.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 10:28:312025-04-28 10:22:09WALKER CHRISTOPHER GOLDSMITHS

https://visitbermudanow.com/wp-content/uploads/2022/05/Walker-Christopher-Goldsmiths.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 10:28:312025-04-28 10:22:09WALKER CHRISTOPHER GOLDSMITHS https://visitbermudanow.com/wp-content/uploads/2022/05/BDA-Triangle_Map-Guide-9.25-x-11.125_24_fin1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 10:15:512024-05-14 03:08:23BERMUDA TRIANGLE SHOP

https://visitbermudanow.com/wp-content/uploads/2022/05/BDA-Triangle_Map-Guide-9.25-x-11.125_24_fin1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 10:15:512024-05-14 03:08:23BERMUDA TRIANGLE SHOP https://visitbermudanow.com/wp-content/uploads/2022/05/Seaglass-Studio.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 10:08:092023-06-02 02:14:09SEAGLASS STUDIO

https://visitbermudanow.com/wp-content/uploads/2022/05/Seaglass-Studio.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 10:08:092023-06-02 02:14:09SEAGLASS STUDIO https://visitbermudanow.com/wp-content/uploads/2022/05/Saltwater-Jewellery-Design.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:58:582022-09-23 03:49:23SALTWATER JEWELLERY DESIGNS

https://visitbermudanow.com/wp-content/uploads/2022/05/Saltwater-Jewellery-Design.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:58:582022-09-23 03:49:23SALTWATER JEWELLERY DESIGNS https://visitbermudanow.com/wp-content/uploads/2022/05/JENNIFER-RODRIGUES.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:41:112022-09-23 03:44:50JENNIFER RODRIGUES DESIGNS

https://visitbermudanow.com/wp-content/uploads/2022/05/JENNIFER-RODRIGUES.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:41:112022-09-23 03:44:50JENNIFER RODRIGUES DESIGNS https://visitbermudanow.com/wp-content/uploads/2022/05/DavidrRose-Studio.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:25:202025-04-27 02:04:40DAVIDROSE STUDIO

https://visitbermudanow.com/wp-content/uploads/2022/05/DavidrRose-Studio.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:25:202025-04-27 02:04:40DAVIDROSE STUDIO https://visitbermudanow.com/wp-content/uploads/2022/05/Crisson-Jewellers.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:12:162025-04-27 02:03:00CRISSON JEWELLERS

https://visitbermudanow.com/wp-content/uploads/2022/05/Crisson-Jewellers.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:12:162025-04-27 02:03:00CRISSON JEWELLERS https://visitbermudanow.com/wp-content/uploads/2022/05/Brown-Co.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 07:58:402025-04-27 01:59:51BROWN & CO.

https://visitbermudanow.com/wp-content/uploads/2022/05/Brown-Co.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 07:58:402025-04-27 01:59:51BROWN & CO. https://visitbermudanow.com/wp-content/uploads/2022/05/Bermuda-Monetary-Authority.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 06:34:262025-04-27 01:58:58BERMUDA MONETARY AUTHORITY

https://visitbermudanow.com/wp-content/uploads/2022/05/Bermuda-Monetary-Authority.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 06:34:262025-04-27 01:58:58BERMUDA MONETARY AUTHORITY https://visitbermudanow.com/wp-content/uploads/2022/05/Alexandra-Mosher-Studio-Jewellery.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 06:25:492023-06-01 04:00:37ALEXANDRA MOSHER STUDIO JEWELLERY

https://visitbermudanow.com/wp-content/uploads/2022/05/Alexandra-Mosher-Studio-Jewellery.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 06:25:492023-06-01 04:00:37ALEXANDRA MOSHER STUDIO JEWELLERY https://visitbermudanow.com/wp-content/uploads/2022/05/Washington-Mall.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 06:18:182022-09-23 03:31:11WASHINGTON MALL

https://visitbermudanow.com/wp-content/uploads/2022/05/Washington-Mall.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 06:18:182022-09-23 03:31:11WASHINGTON MALL https://visitbermudanow.com/wp-content/uploads/2022/05/The-Lili-Bermuda-Perfumery.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 01:03:092023-06-01 09:22:00LILI BERMUDA PERFUMERY

https://visitbermudanow.com/wp-content/uploads/2022/05/The-Lili-Bermuda-Perfumery.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 01:03:092023-06-01 09:22:00LILI BERMUDA PERFUMERY