BERMUDA MONETARY AUTHORITY

The Bermuda Monetary Authority (BMA) is the regulator of Bermuda’s financial services industry. Established by statute in 1969, the BMA has changed significantly over almost five decades to meet the changing needs of the financial services sector on a local and global scale. The comprehensive macroprudential regulatory approach has become an integral part of its tool kit in reducing the risk of instability of the financial services sector. Coupled with this approach is the BMA’s sup- port of Bermuda’s overall framework in order to create a secure and stable financial environment in Bermuda whilst ensuring that the island remains an attractive jurisdiction for conducting local and international business. Additional responsibilities for the BMA include issuing Bermuda’s national cur- rency, managing exchange control transactions, assisting other agencies with the detection and prevention of financial crime, and advising the government on banking and other financial and monetary matters. The BMA develops risk-based financial regulations that it applies to the supervision of Bermuda’s banks, trust companies, investment businesses, investment funds, fund administrators, money ser- vice businesses, corporate service providers, and insurance companies. It also regulates the Bermuda Stock Exchange.

All “Shopping”

https://visitbermudanow.com/wp-content/uploads/2024/04/1-21.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 06:18:272024-04-30 06:18:29OUTERBRIDGE’S ORIGINAL

https://visitbermudanow.com/wp-content/uploads/2024/04/1-21.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 06:18:272024-04-30 06:18:29OUTERBRIDGE’S ORIGINAL https://visitbermudanow.com/wp-content/uploads/2024/04/1-14.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 06:12:302024-04-30 06:12:32MARVALAN’S HANDBAGS & ACCESSORIES

https://visitbermudanow.com/wp-content/uploads/2024/04/1-14.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 06:12:302024-04-30 06:12:32MARVALAN’S HANDBAGS & ACCESSORIES https://visitbermudanow.com/wp-content/uploads/2024/04/1-12.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 06:01:282024-04-30 06:01:29KULTURA BERMUDA CULTURE

https://visitbermudanow.com/wp-content/uploads/2024/04/1-12.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 06:01:282024-04-30 06:01:29KULTURA BERMUDA CULTURE https://visitbermudanow.com/wp-content/uploads/2024/04/1-18.jpg

270

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 05:53:432024-04-30 05:54:17HARBOUR NIGHTS

https://visitbermudanow.com/wp-content/uploads/2024/04/1-18.jpg

270

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 05:53:432024-04-30 05:54:17HARBOUR NIGHTS https://visitbermudanow.com/wp-content/uploads/2024/04/1-10.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 05:39:502024-04-30 05:39:52DREAMSCAPE DESIGNS

https://visitbermudanow.com/wp-content/uploads/2024/04/1-10.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 05:39:502024-04-30 05:39:52DREAMSCAPE DESIGNS https://visitbermudanow.com/wp-content/uploads/2024/04/1-16.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 05:13:182024-04-30 05:13:20BERMUDA JEWELLERY LTD

https://visitbermudanow.com/wp-content/uploads/2024/04/1-16.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 05:13:182024-04-30 05:13:20BERMUDA JEWELLERY LTD https://visitbermudanow.com/wp-content/uploads/2024/04/1-7.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 03:15:082024-04-30 03:22:50DISCOVERY WINES & SPIRITS

https://visitbermudanow.com/wp-content/uploads/2024/04/1-7.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2024-04-30 03:15:082024-04-30 03:22:50DISCOVERY WINES & SPIRITS https://visitbermudanow.com/wp-content/uploads/2023/06/sargasso.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-03 01:35:072023-06-03 01:35:08SARGASSO / PRONTO RETAIL & FOOD SHOPPING DELIVERY

https://visitbermudanow.com/wp-content/uploads/2023/06/sargasso.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-03 01:35:072023-06-03 01:35:08SARGASSO / PRONTO RETAIL & FOOD SHOPPING DELIVERY https://visitbermudanow.com/wp-content/uploads/2023/06/THINGS-WE-LOVE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-02 00:16:012023-06-02 02:13:37THE THINGS WE LOVE

https://visitbermudanow.com/wp-content/uploads/2023/06/THINGS-WE-LOVE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-02 00:16:012023-06-02 02:13:37THE THINGS WE LOVE https://visitbermudanow.com/wp-content/uploads/2023/06/RUM-BARREL-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 23:56:002023-06-02 00:07:02THE RUM BARREL

https://visitbermudanow.com/wp-content/uploads/2023/06/RUM-BARREL-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 23:56:002023-06-02 00:07:02THE RUM BARREL https://visitbermudanow.com/wp-content/uploads/2023/06/Mussels-Jewellery-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 10:01:392023-06-02 04:35:03MUSSELS JEWELLERY

https://visitbermudanow.com/wp-content/uploads/2023/06/Mussels-Jewellery-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 10:01:392023-06-02 04:35:03MUSSELS JEWELLERY https://visitbermudanow.com/wp-content/uploads/2023/06/MARKS-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 09:44:532023-06-01 09:44:55MARKS & SPENCER

https://visitbermudanow.com/wp-content/uploads/2023/06/MARKS-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 09:44:532023-06-01 09:44:55MARKS & SPENCER https://visitbermudanow.com/wp-content/uploads/2023/06/LUSSO-1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 09:25:362023-06-01 09:33:06LUSSO

https://visitbermudanow.com/wp-content/uploads/2023/06/LUSSO-1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 09:25:362023-06-01 09:33:06LUSSO https://visitbermudanow.com/wp-content/uploads/2023/06/ENGLISH-SPORTS-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 05:20:072023-06-01 05:33:07THE ENGLISH SPORTS SHOP

https://visitbermudanow.com/wp-content/uploads/2023/06/ENGLISH-SPORTS-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 05:20:072023-06-01 05:33:07THE ENGLISH SPORTS SHOP https://visitbermudanow.com/wp-content/uploads/2023/06/CUARENTOS-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:58:482023-06-01 05:06:24CUARENTA BUCANEROS LIMITED

https://visitbermudanow.com/wp-content/uploads/2023/06/CUARENTOS-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:58:482023-06-01 05:06:24CUARENTA BUCANEROS LIMITED https://visitbermudanow.com/wp-content/uploads/2023/06/CHATHAM-HOUSE-FEATURE.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:41:012023-06-01 04:45:59CHATHAM HOUSE

https://visitbermudanow.com/wp-content/uploads/2023/06/CHATHAM-HOUSE-FEATURE.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:41:012023-06-01 04:45:59CHATHAM HOUSE https://visitbermudanow.com/wp-content/uploads/2023/06/BERMUDA-FUDGE-FEATURE.jpeg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:21:562023-06-01 04:31:12BERMUDA FUDGE CO.

https://visitbermudanow.com/wp-content/uploads/2023/06/BERMUDA-FUDGE-FEATURE.jpeg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:21:562023-06-01 04:31:12BERMUDA FUDGE CO. https://visitbermudanow.com/wp-content/uploads/2023/06/BERMUDA-FRAGRANCE-FEATURE.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:02:062023-06-01 04:13:07BERMUDA FRAGRANCE COLLECTION

https://visitbermudanow.com/wp-content/uploads/2023/06/BERMUDA-FRAGRANCE-FEATURE.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 04:02:062023-06-01 04:13:07BERMUDA FRAGRANCE COLLECTION https://visitbermudanow.com/wp-content/uploads/2023/06/CRISSON-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 01:51:482023-06-01 04:50:30CRISSON & HIND AFRICAN GALLERY

https://visitbermudanow.com/wp-content/uploads/2023/06/CRISSON-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-06-01 01:51:482023-06-01 04:50:30CRISSON & HIND AFRICAN GALLERY https://visitbermudanow.com/wp-content/uploads/2023/05/BERMUDA-SHOP.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-05-31 04:42:592023-06-01 04:35:59BERMUDA SHOP BY CAROLE HOLDING

https://visitbermudanow.com/wp-content/uploads/2023/05/BERMUDA-SHOP.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2023-05-31 04:42:592023-06-01 04:35:59BERMUDA SHOP BY CAROLE HOLDING https://visitbermudanow.com/wp-content/uploads/2022/09/modern-lifestyle-feature.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-25 04:47:062023-07-11 00:38:27MODERN LIFESTYLE

https://visitbermudanow.com/wp-content/uploads/2022/09/modern-lifestyle-feature.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-25 04:47:062023-07-11 00:38:27MODERN LIFESTYLE https://visitbermudanow.com/wp-content/uploads/2022/09/MERCH-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 11:17:492022-09-23 03:48:15MERCH.

https://visitbermudanow.com/wp-content/uploads/2022/09/MERCH-FEATURE.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 11:17:492022-09-23 03:48:15MERCH. https://visitbermudanow.com/wp-content/uploads/2022/09/THE-BERMUDA-CRAFT-MARKET.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 04:23:142022-09-23 03:34:01BERMUDA CRAFT MARKET

https://visitbermudanow.com/wp-content/uploads/2022/09/THE-BERMUDA-CRAFT-MARKET.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 04:23:142022-09-23 03:34:01BERMUDA CRAFT MARKET https://visitbermudanow.com/wp-content/uploads/2022/09/swiss-jewellers.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 04:12:242022-09-23 03:28:09SWISS JEWELLERS

https://visitbermudanow.com/wp-content/uploads/2022/09/swiss-jewellers.jpg

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

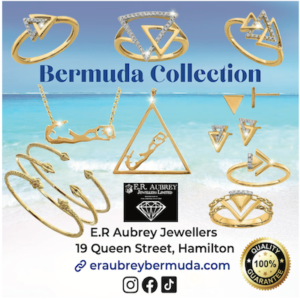

Mark Cramer2022-09-07 04:12:242022-09-23 03:28:09SWISS JEWELLERS https://visitbermudanow.com/wp-content/uploads/2022/09/ER-AUBREY-JEWELLERS-1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 03:36:452022-09-23 03:25:30ER AUBREY JEWELLERS LIMITED

https://visitbermudanow.com/wp-content/uploads/2022/09/ER-AUBREY-JEWELLERS-1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 03:36:452022-09-23 03:25:30ER AUBREY JEWELLERS LIMITED https://visitbermudanow.com/wp-content/uploads/2022/09/59-Front2-1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 03:29:552023-06-01 03:58:2059 FRONT

https://visitbermudanow.com/wp-content/uploads/2022/09/59-Front2-1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-09-07 03:29:552023-06-01 03:58:2059 FRONT https://visitbermudanow.com/wp-content/uploads/2022/05/Robertsons-Drug-Store-.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 09:58:182024-04-30 06:21:10ROBERTSON’S DRUG STORE

https://visitbermudanow.com/wp-content/uploads/2022/05/Robertsons-Drug-Store-.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 09:58:182024-04-30 06:21:10ROBERTSON’S DRUG STORE https://visitbermudanow.com/wp-content/uploads/2022/05/Frangipani-St-George.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 09:50:572023-06-01 09:07:43FRANGIPANI

https://visitbermudanow.com/wp-content/uploads/2022/05/Frangipani-St-George.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 09:50:572023-06-01 09:07:43FRANGIPANI https://visitbermudanow.com/wp-content/uploads/2022/05/dock-shop.png

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 09:33:402022-09-23 03:45:40DOCKSHOP AT PIER 41 MARINA

https://visitbermudanow.com/wp-content/uploads/2022/05/dock-shop.png

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

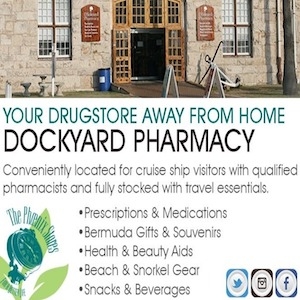

Mark Cramer2022-05-29 09:33:402022-09-23 03:45:40DOCKSHOP AT PIER 41 MARINA https://visitbermudanow.com/wp-content/uploads/2022/05/Dockyard-Pharmacy-1.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 05:14:302022-09-23 03:43:28DOCKYARD PHARMACY

https://visitbermudanow.com/wp-content/uploads/2022/05/Dockyard-Pharmacy-1.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 05:14:302022-09-23 03:43:28DOCKYARD PHARMACY https://visitbermudanow.com/wp-content/uploads/2022/05/Diamonds-International-Dockyard.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 05:03:152023-06-01 05:13:00DIAMONDS INTERNATIONAL BERMUDA

https://visitbermudanow.com/wp-content/uploads/2022/05/Diamonds-International-Dockyard.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 05:03:152023-06-01 05:13:00DIAMONDS INTERNATIONAL BERMUDA https://visitbermudanow.com/wp-content/uploads/2022/05/Churchills-Ltd.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 04:53:262024-04-30 05:25:43CHURCHILL’S LTD.

https://visitbermudanow.com/wp-content/uploads/2022/05/Churchills-Ltd.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 04:53:262024-04-30 05:25:43CHURCHILL’S LTD. https://visitbermudanow.com/wp-content/uploads/2022/05/9-Parishes.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 04:12:282023-06-01 02:10:039 PARISHES AUTHENTIC RUM

https://visitbermudanow.com/wp-content/uploads/2022/05/9-Parishes.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 04:12:282023-06-01 02:10:039 PARISHES AUTHENTIC RUM https://visitbermudanow.com/wp-content/uploads/2022/05/The-Littlest-Drawbridge-Gift-Shop.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:55:512022-09-23 03:47:03LITTLEST DRAWBRIDGE GIFT SHOP

https://visitbermudanow.com/wp-content/uploads/2022/05/The-Littlest-Drawbridge-Gift-Shop.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:55:512022-09-23 03:47:03LITTLEST DRAWBRIDGE GIFT SHOP https://visitbermudanow.com/wp-content/uploads/2022/05/fair-trade.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:49:502022-09-23 03:46:27FAIR TRADE BERMUDA SHOP

https://visitbermudanow.com/wp-content/uploads/2022/05/fair-trade.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:49:502022-09-23 03:46:27FAIR TRADE BERMUDA SHOP https://visitbermudanow.com/wp-content/uploads/2022/05/GRAND-BAZAAR.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:32:162022-09-23 03:44:08GRAND BAZAAR

https://visitbermudanow.com/wp-content/uploads/2022/05/GRAND-BAZAAR.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:32:162022-09-23 03:44:08GRAND BAZAAR https://visitbermudanow.com/wp-content/uploads/2022/05/touche.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:15:562022-09-23 03:30:07TOUCHE’

https://visitbermudanow.com/wp-content/uploads/2022/05/touche.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 03:15:562022-09-23 03:30:07TOUCHE’ https://visitbermudanow.com/wp-content/uploads/2022/05/The-Phoenix-Stores-Ltd..jpg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:50:492022-09-23 03:29:37PHOENIX STORES LTD.

https://visitbermudanow.com/wp-content/uploads/2022/05/The-Phoenix-Stores-Ltd..jpg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:50:492022-09-23 03:29:37PHOENIX STORES LTD. https://visitbermudanow.com/wp-content/uploads/2022/05/TABS-The-Authentic-Bermuda-Shorts.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:44:412023-06-02 00:14:10TABS – THE AUTHENTIC BERMUDA SHORTS

https://visitbermudanow.com/wp-content/uploads/2022/05/TABS-The-Authentic-Bermuda-Shorts.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:44:412023-06-02 00:14:10TABS – THE AUTHENTIC BERMUDA SHORTS https://visitbermudanow.com/wp-content/uploads/2022/05/Goslings-Merchandise.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:30:562022-09-23 03:32:53GOSLINGS MERCHANDISE

https://visitbermudanow.com/wp-content/uploads/2022/05/Goslings-Merchandise.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:30:562022-09-23 03:32:53GOSLINGS MERCHANDISE https://visitbermudanow.com/wp-content/uploads/2022/05/Goslings.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:26:422023-06-01 09:10:25GOSLINGS

https://visitbermudanow.com/wp-content/uploads/2022/05/Goslings.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:26:422023-06-01 09:10:25GOSLINGS https://visitbermudanow.com/wp-content/uploads/2022/05/p-tech.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:14:412024-04-26 03:52:15P-TECH

https://visitbermudanow.com/wp-content/uploads/2022/05/p-tech.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:14:412024-04-26 03:52:15P-TECH https://visitbermudanow.com/wp-content/uploads/2022/05/Flying-Colours-1.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:06:482022-09-23 03:26:21FLYING COLOURS

https://visitbermudanow.com/wp-content/uploads/2022/05/Flying-Colours-1.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-29 02:06:482022-09-23 03:26:21FLYING COLOURS https://visitbermudanow.com/wp-content/uploads/2022/05/confections_logo.png

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-28 08:20:582022-09-25 05:12:40CONFECTIONS

https://visitbermudanow.com/wp-content/uploads/2022/05/confections_logo.png

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-28 08:20:582022-09-25 05:12:40CONFECTIONS https://visitbermudanow.com/wp-content/uploads/2022/05/Bermuda-Duty-Free-BDF.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-28 07:05:002022-09-23 03:22:10BERMUDA DUTY FREE (BDF)

https://visitbermudanow.com/wp-content/uploads/2022/05/Bermuda-Duty-Free-BDF.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-28 07:05:002022-09-23 03:22:10BERMUDA DUTY FREE (BDF) https://visitbermudanow.com/wp-content/uploads/2022/05/27-Century-Boutique.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-28 06:47:162022-09-23 03:20:2627TH CENTURY BOUTIQUE

https://visitbermudanow.com/wp-content/uploads/2022/05/27-Century-Boutique.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-28 06:47:162022-09-23 03:20:2627TH CENTURY BOUTIQUE https://visitbermudanow.com/wp-content/uploads/2022/05/LITTLE-LONGTAILS.png

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-27 00:16:542022-09-23 03:33:26LITTLE LONGTAILS BABY & RENTAL EQUIPMENT

https://visitbermudanow.com/wp-content/uploads/2022/05/LITTLE-LONGTAILS.png

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-27 00:16:542022-09-23 03:33:26LITTLE LONGTAILS BABY & RENTAL EQUIPMENT https://visitbermudanow.com/wp-content/uploads/2022/05/Walker-Christopher-Goldsmiths.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 10:28:312023-06-02 02:20:40WALKER CHRISTOPHER GOLDSMITHS

https://visitbermudanow.com/wp-content/uploads/2022/05/Walker-Christopher-Goldsmiths.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 10:28:312023-06-02 02:20:40WALKER CHRISTOPHER GOLDSMITHS https://visitbermudanow.com/wp-content/uploads/2022/05/BDA-Triangle_Map-Guide-9.25-x-11.125_24_fin1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 10:15:512024-05-14 03:08:23BERMUDA TRIANGLE SHOP

https://visitbermudanow.com/wp-content/uploads/2022/05/BDA-Triangle_Map-Guide-9.25-x-11.125_24_fin1.png

400

400

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 10:15:512024-05-14 03:08:23BERMUDA TRIANGLE SHOP https://visitbermudanow.com/wp-content/uploads/2022/05/Seaglass-Studio.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 10:08:092023-06-02 02:14:09SEAGLASS STUDIO

https://visitbermudanow.com/wp-content/uploads/2022/05/Seaglass-Studio.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 10:08:092023-06-02 02:14:09SEAGLASS STUDIO https://visitbermudanow.com/wp-content/uploads/2022/05/Saltwater-Jewellery-Design.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:58:582022-09-23 03:49:23SALTWATER JEWELLERY DESIGNS

https://visitbermudanow.com/wp-content/uploads/2022/05/Saltwater-Jewellery-Design.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:58:582022-09-23 03:49:23SALTWATER JEWELLERY DESIGNS https://visitbermudanow.com/wp-content/uploads/2022/05/JENNIFER-RODRIGUES.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:41:112022-09-23 03:44:50JENNIFER RODRIGUES DESIGNS

https://visitbermudanow.com/wp-content/uploads/2022/05/JENNIFER-RODRIGUES.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:41:112022-09-23 03:44:50JENNIFER RODRIGUES DESIGNS https://visitbermudanow.com/wp-content/uploads/2022/05/DavidrRose-Studio.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:25:202022-09-23 03:24:45DAVIDROSE STUDIO

https://visitbermudanow.com/wp-content/uploads/2022/05/DavidrRose-Studio.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:25:202022-09-23 03:24:45DAVIDROSE STUDIO https://visitbermudanow.com/wp-content/uploads/2022/05/Crisson-Jewellers.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:12:162023-06-01 04:53:14CRISSON JEWELLERS

https://visitbermudanow.com/wp-content/uploads/2022/05/Crisson-Jewellers.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 09:12:162023-06-01 04:53:14CRISSON JEWELLERS https://visitbermudanow.com/wp-content/uploads/2022/05/Brown-Co.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 07:58:402022-09-23 03:23:12BROWN & CO.

https://visitbermudanow.com/wp-content/uploads/2022/05/Brown-Co.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 07:58:402022-09-23 03:23:12BROWN & CO. https://visitbermudanow.com/wp-content/uploads/2022/05/Bermuda-Monetary-Authority.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 06:34:262023-06-03 02:18:03BERMUDA MONETARY AUTHORITY

https://visitbermudanow.com/wp-content/uploads/2022/05/Bermuda-Monetary-Authority.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 06:34:262023-06-03 02:18:03BERMUDA MONETARY AUTHORITY https://visitbermudanow.com/wp-content/uploads/2022/05/Alexandra-Mosher-Studio-Jewellery.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 06:25:492023-06-01 04:00:37ALEXANDRA MOSHER STUDIO JEWELLERY

https://visitbermudanow.com/wp-content/uploads/2022/05/Alexandra-Mosher-Studio-Jewellery.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 06:25:492023-06-01 04:00:37ALEXANDRA MOSHER STUDIO JEWELLERY https://visitbermudanow.com/wp-content/uploads/2022/05/Washington-Mall.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 06:18:182022-09-23 03:31:11WASHINGTON MALL

https://visitbermudanow.com/wp-content/uploads/2022/05/Washington-Mall.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 06:18:182022-09-23 03:31:11WASHINGTON MALL https://visitbermudanow.com/wp-content/uploads/2022/05/The-Lili-Bermuda-Perfumery.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 01:03:092023-06-01 09:22:00LILI BERMUDA PERFUMERY

https://visitbermudanow.com/wp-content/uploads/2022/05/The-Lili-Bermuda-Perfumery.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-26 01:03:092023-06-01 09:22:00LILI BERMUDA PERFUMERY https://visitbermudanow.com/wp-content/uploads/2022/05/Clocktower-Shopping-Mall.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-25 09:34:112022-09-23 03:42:15CLOCKTOWER SHOPPING MALL

https://visitbermudanow.com/wp-content/uploads/2022/05/Clocktower-Shopping-Mall.jpeg

300

300

Mark Cramer

https://visitbermudanow.com/wp-content/uploads/2024/01/LOGO-WHITE.png

Mark Cramer2022-05-25 09:34:112022-09-23 03:42:15CLOCKTOWER SHOPPING MALL